Contents:

Most other Western countries, certainly the US and the UK, are in no position to invest heavily to maintain a particular exchange rate. The London markets have waited 18 long years already for the Bank of England to appear on their screens, and I suspect their wait will continue for some time yet. Britain was left with no option but to leave the ERM, a decision that was hastened when British pound came under speculative attack by the likes of hedge fund manager, George Soros. The British pound was devalued but not before the government had tried unsuccessfully to hold on to stay in the ERM.

For example, George Soros pledged close to a billion dollars to stop Modi at the World Economic Forum in Davos in 2020. Right now, we have only seen international players get involved in our national level politics. Before this decade is out, we will see the impact at the state, and even the city level. Socialism is a morality play, but the problem is that it doesn’t actually produce anything.

How to make a billion Pounds in a day.

Prior to this, he has worked at Societe General Corporate & Investment Bank in London and Paris and at UBS Investment Bank in London and Hong Kong in Quant equity research, investment management, and derivative structuring roles. Manish has over 14 years of experience in financial markets and is a very sought after name for comments on global markets and economy. After the war, Soros immigrated to England and attended the London School of Economics, where he earned a bachelor’s and a master’s degree in philosophy. Soros began his financial career in London as a trader and analyst for various firms, eventually founding his own hedge fund, Soros Fund Management, in 1969. He became famous in the financial world for his investment success, particularly in currency speculation.

So, the European nations decided to make a range for all the other currencies. When that happens, markets enter into a state of dynamic disequilibrium and behave quite differently from what would be considered normal by the theory of efficient markets. Such boom/bust sequences do not arise very often, but when they do, they can be very disruptive, exactly because they affect the fundamentals of the economy,_ he said. Mr Soros also emphasised on the importance of judgment while dealing with financial markets.

The Alchemy of Finance (English, Paperback, Soros G)

Today, monetary markets and customers are being eased into higher rates of interest and the influence is being priced in well prematurely of the particular hikes. The Black Wednesday price rise was sudden and the first for 3 years and due to this fact the market both panicked in confusion or lacked confidence within the government’s ability to deliver the pound under control. The Confederation of British Industry was quick to criticise the rate rise and the fact that government had been ‘blown off track by the currency markets’, warning of the impression of pricier mortgages on the housing market.

The world listens to George Soros. Should India? – Times of India

The world listens to George Soros. Should India?.

Posted: Sat, 18 Feb 2023 08:00:00 GMT [source]

In his view, capital controls have their uses in times of crisis. The sheer size of the Indian economy will now attract every kind of player. Going ahead, the impact of each policy decision will be in billions of dollars. That means both our economy and our politics will be internationalized.

File ITR, invest & save upto ₹46,800 in taxes on the go

But could a short seller from Wall Street really be the kind of hero that Bachchan saab used to play? For all you know, maybe Hindenburg didn’t even take a short position. So much for those who thought Hindenburg was a “global research institution.” Everything here is morally ambiguous. As new India creates more and more business tycoons, there will be many more such battles.

When did Blackout Wednesday become a thing?

When Did Blackout Wednesday Start? The term Blackout Wednesday was first coined online in 2004, though it didn't become a mainstream term until the early 2010s. It's important to note that people across the country could have engaged in their own form of Blackout Wednesday years before this.

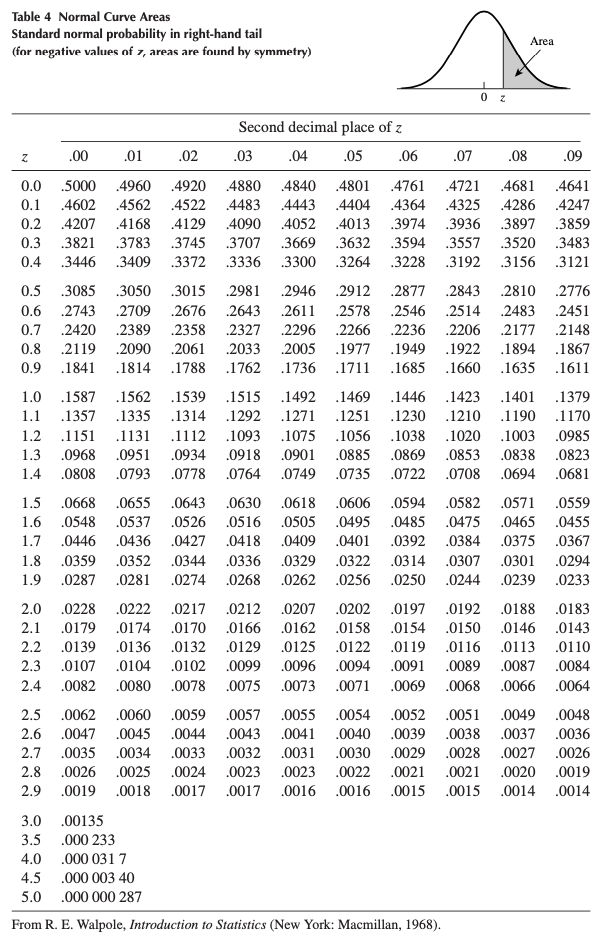

Investing in Oil, and seeing its price rise means you can sell it for a profit. As sterling had joined the ERM at a charge of DM2.95 to the pound, that meant it was not presupposed to commerce at greater than DM3.127 or lower than DM2.773. The predominant means by which sterling was presupposed to commerce in such a decent vary towards the mark was mainly by setting UK rates of interest near the extent set by Germany’s Bundesbank. At the time, the pound was within the European change charge mechanism – the system that yoked collectively the currencies of assorted European nations forward of the creation of the euro. Under the ERM, currencies such because the French franc, the Italian lira, the German deutschemark or the pound had been presupposed to commerce with one another in a decent vary, described as “currency convergence”. For example, Paul De Grauwe of the University of Leuven has proposed that the European Central Bank intervene when exchange rate developments are out of touch with reality, in order to send a signal to the markets.

Read more from

But the Swiss reported losses of 14 billion francs in the first half of 2010, without succeeding in stemming exchange rate appreciation. This episode, which other central banks watched with great interest, tended to reinforce the views of those who are sceptical of monetary authorities’ ability to manage exchange rates. Soros had recognized the unfavorable position of the United Kingdom within the European Exchange Rate Mechanism. For Soros, the rate at which the United Kingdom was introduced into the European Exchange Rate Mechanism was too high, their inflation was additionally a lot too excessive , and British interest rates have been hurting their asset costs.

George Soros is a well-known Hungarian-born American investor, philanthropist, and political activist. He was born on August 12, 1930, in Budapest, Hungary, to a non-practicing Jewish family. Soros survived the Nazi occupation of Hungary during World War II by assuming a false identity and helping his family do the same. Biillioniare George Soros recently said that Indian tycoon Gautam Adani’s woes will lead to a „democratic revival” in India. Soros made this comment at the Munich Security Conference, as per a report from Financial Times. “Modi and business tycoon Adani are close allies; their fate is intertwined,” the former Hedge Fund manager said.

The underlying problem remains that, while both central banks and finance ministries are unhappy about the excessive volatility of real and nominal exchange rates, they do not understand very well what causes it. They may think that, in the long run, parities will reflect developments in relative unit labour costs. But the long run can be long indeed, and the influence of speculative capital flows can be substantial and sustained. Since then, the Bank of England has eschewed all forms of intervention in the foreign exchange markets. And the episode served to reinforce an international consensus that monetary policy should focus on domestic price stability while letting exchange rates float freely. The US economy is reeling under high inflation but its aggressive monetary policy and better economic prospects mean investors prefer the USD to other currencies.

Who was responsible for Black Wednesday?

Key Takeaways. Black Wednesday refers to September 16, 1992, when a collapse in the pound sterling forced Britain to withdraw from the European Exchange Rate Mechanism (ERM). Because of his role in Black Wednesday, George Soros is known for ‚breaking the Bank of England.’

The UK then raised interest rates twice in a day from its base rate of 10% to 12% and from 12% to 15% which was devastating to the economy since it was already going through a recession. The central bank had purchased around £27 Billion but it could not contain the rate since most of the currency markets had been shorting the pound. Later that day, the UK accepted defeat and was forced to withdraw from the ERM. The following day the Pound fell by 15% against DEM and 25% against USD. Through this short Soros through his hedge fund made around £1 Billion. Two years before Black Wednesday the UK entered the European Exchange Rate Mechanism .

Shortly thereafter, Major replaced Thatcher as prime minister and fixed exchange rate system was the centre piece of his economic plan to combat inflation in the economy. With British monetary policy now tied by the exchange rate agreement, the government couldn’t play with the money supply and to a certain extent, the policy worked. Between 1990 and 1992, inflation decreased from 9.5 per cent to 3.7 per cent.

On 31 December 1998, the European Currency Unit change charges of the eurozone countries were frozen and the worth of the euro, which then outmoded the ECU at par, was thus established. Determined intervention and mortgage preparations protected the participating currencies from greater trade fee fluctuations. Black Wednesday refers to September 16, 1992, when a collapse within the pound sterling compelled Britain to withdraw from the European Exchange Rate Mechanism.

Why did George Soros bet against the pound?

4 Soros recognized the pound was overvalued versus the German mark and started to bet against the British currency. In response to these comments by German officials, Soros decided to increase the size of his bet massively. He went from a $1.5 billion position to a massive $10 billion in the middle of September.

In this respect, it was funny to see black wednesday george soros trying to use their outdated Nehruvian moral compass to find their way in the bruising battle over the last two weeks. Adani Group has been accused by US short seller Hindenburg Group of engaging in “brazen stock manipulation and accounting fraud” over decades, a claim that Adani Group has stoutly denied. A short sale is a transaction in which the lender , or lenders, agree to accept less than the mortgage amount owed by the current homeowner . This can occur when a homeowner in dire financial trouble sells their home for less than they owe on the mortgage . In order to facilitate the short sale, the lender may agree to accept a reduced amount of money and forgive the remaining debt.

- Written in comprehensive English, this book is wisely divided into five sections that deals with the author’s personal views of several topics and theories related to the economy.

- Today, we’ll learn about such a trader whose story is inspirational, motivational, and shocking too.

- On eight October 1990, Thatcher entered the pound into the ERM mechanism at DM 2.95 to the pound.

- Being the world’s fifth largest economy, soon to be the third, comes with an end to our innocence.

- After the Black Wednesday contributed to economic prosperity, lower unemployment, and less inflation.

Many https://1investing.in/ including various economists and speculators noted this to be unsustainable and expected the UK to leave the ERM and devalue its currency. After Black Wednesday, it became conventional wisdom that it was impossible to fix both the exchange rate and domestic monetary conditions at the same time. According to this view, in a market economy with a convertible currency and free capital flows, the rate cannot be manipulated without consequent adjustments to other dimensions.

What happens if the pound collapse?

A fall in the value of the pound will increase the price of goods and services imported into the UK from overseas. That's because when the pound is weak against the dollar or euro, for example, it costs more for companies in the UK to buy things such as food, raw materials or parts from abroad.

0 Komentarzy